GBP/USD Price Analysis: Remains vulnerable to slide further, possibly towards sub-1.2900 levels

- GBP/USD extends the previous session’s pullback and weakens farther below 1.30 mark.

- Bears are likely to aim towards testing a short-term descending trend-channel support.

The GBP/USD pair remained depressed for the second consecutive session and extended the previous session's sharp intraday pullback from levels beyond the 1.3100 round-figure mark.

The pair weakened farther below the key 1.30 psychological mark, albeit has managed to find some support ahead of monthly swing lows, around the 1.2950-45 region set on January 14.

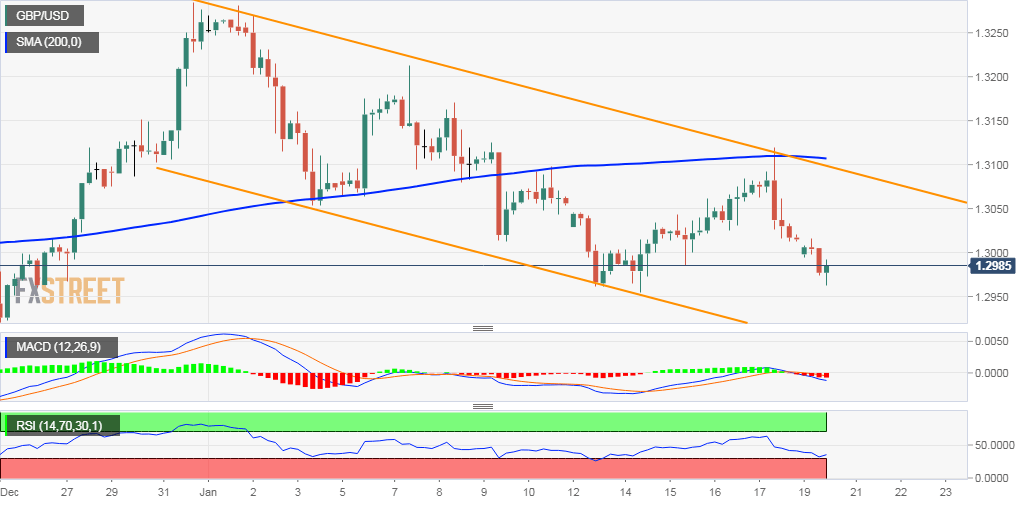

Meanwhile, the recent price action over the past three weeks or so has been confined well within a descending trend-channel formation, which points to a well-established bearish trend.

Technical indicators on hourly/daily charts maintained their negative bias and further support prospects for an extension of the recent sharp pullback from the post-UK election swing highs.

Some follow-through selling below monthly lows will reaffirm the bearish outlook and accelerate the slide towards sub-1.2900 levels, or the lower end of the descending trend channel.

On the flip side, the 1.3000-1.3010 region now seems to act as an immediate resistance, above which the pair could climb towards the 1.3050-55 zone en-route the 1.3085 supply zone (channel resistance).

GBP/USD 4-hourly chart