Back

27 Jan 2020

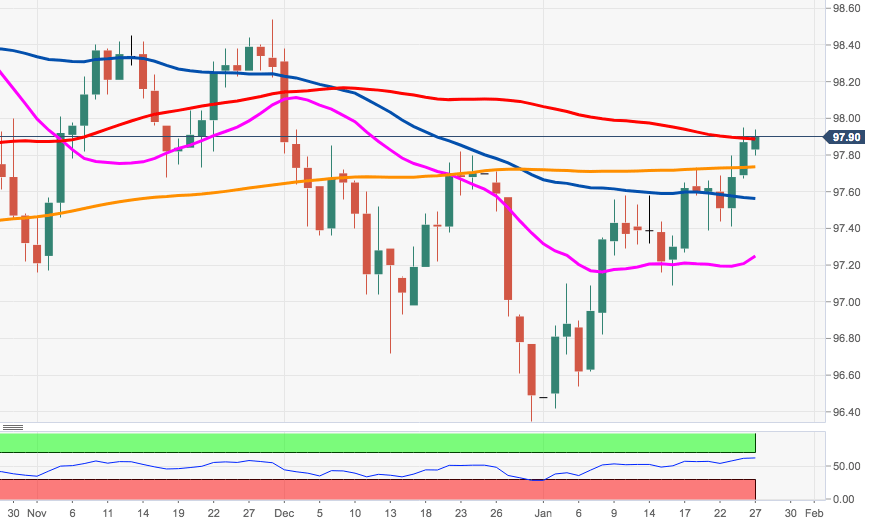

US Dollar Index Price Analysis: The 98.00 region looms closer

- The bull run in DXY advances further north of the 200-day SMA.

- The dollar has regained the near-term positive outlook.

DXY keeps the positive mood at the beginning of the week and continues to target the 98.00 neighbourhood and beyond in the short-term horizon.

The 100-day SMA and a Fibo retracement of the 2017-2018 drop are offering some resistance in the 97.90 region, or yearly highs.

Above this area, the index should target the 98.00 mark ahead of November’s peaks in the mid-98.00s.

DXY daily chart