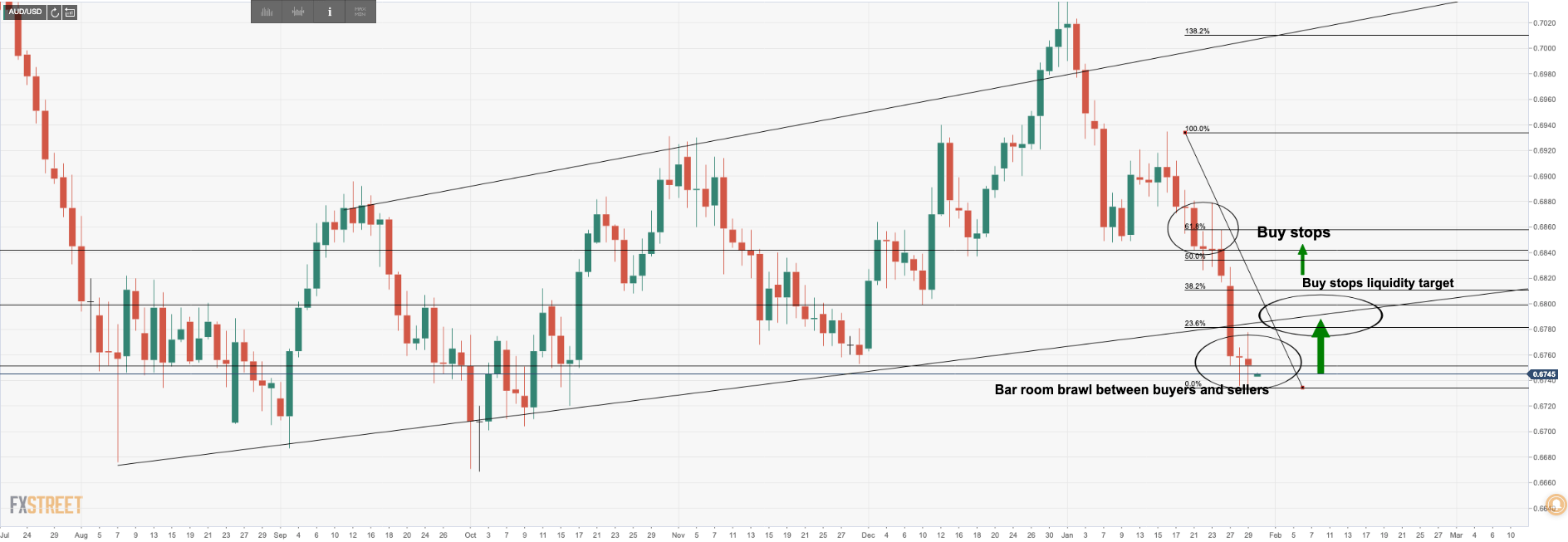

AUD/USD Price Analysis: Potential bear trap at major support area, target 0.68

- AUD/USD bulls looking to buy into the buy stop liquidity.

- Stops will be located above trendline support and subsequent resistance on the way to 0.6880s.

AUD/USD has been a head-scratcher following a series of better data of late, a discounted probability that the Reserve Bank of Australia will cut rates as soon as Feb 4th meeting and a series of supply without a glimpse of a correction, as of yet.

This leads to the presumption that a correction is in order and soon, especially considering that the price is now down to a critical level and a likely pool, changing hands in the liquidity of buys and sells stops which means it really is a battle of the bears and bulls at this juncture. One would presume, that given how deep the move has been, that the price is juggling between retail orders as well as large investor asset management as well as commercial positions.

AUD/USD daily chart: Bulls look to the golden ratio target

Meanwhile, from a technical point of view, the price has broken below a rising support line and a correction here will make for a bear trap. consequently, the price could shoot higher towards the 0.68 handle and target buy stop liquidity in he 23.6% Fibonacci confluence with trendline support before reaching the prior support area of 0.6829 and 0.6850/60 – (golden ratio 61.8% target). Alternatively, 0.6650 is the monthly low.